Social security wep calculator

Eugene Steuerle and Adam Carasso created a Web-based Social Security benefits calculator. Skip advert There are ways you can lower.

Social Security S Windfall Elimination Provision Georgia Estate Plan Worrall Law Llc

The Social Security Trustees annual report estimates that taxes on Social Security will total 451 billion in 2022 up from 345 billion in 2021.

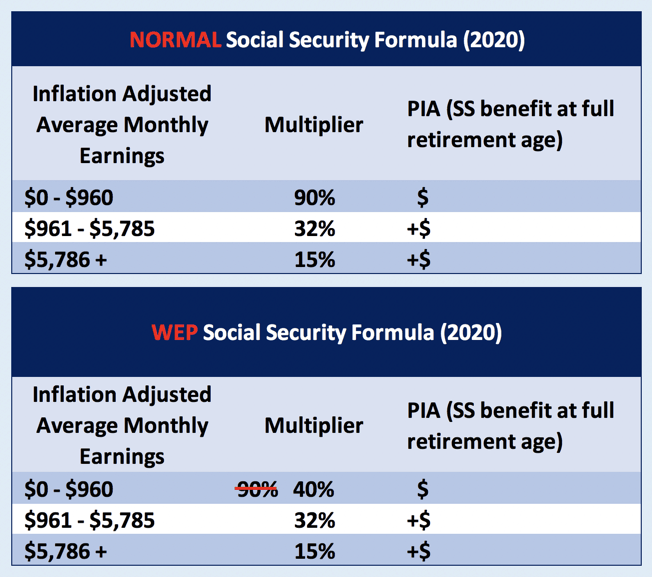

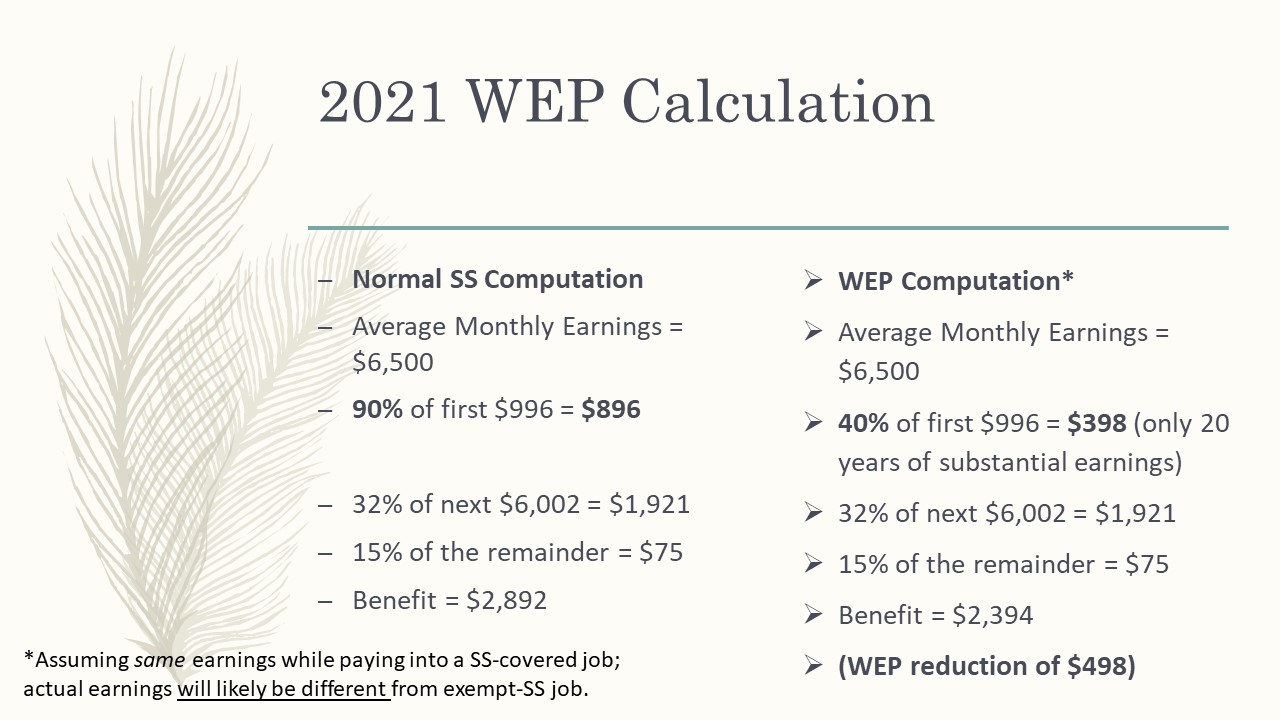

. The WEP is simply an alternate formula for calculating Social Security benefits for those who have a pension from a job where no Social Security taxes were paid. You also need to enter the monthly amount of your pension that was based on work not covered by Social Security. Civil service was brought under the Social Security system.

About 19 million people or 3 percent of Social Security recipients have their benefits reduced by the WEP according to the Congressional Research Service. As with military retirement pay receiving VA disability benefits does not have an impact on Social Security benefits but can affect SSI eligibility and payments. The WEP primarily affects retirees from some state and local government bodies and federal workers hired before 1984 when the US.

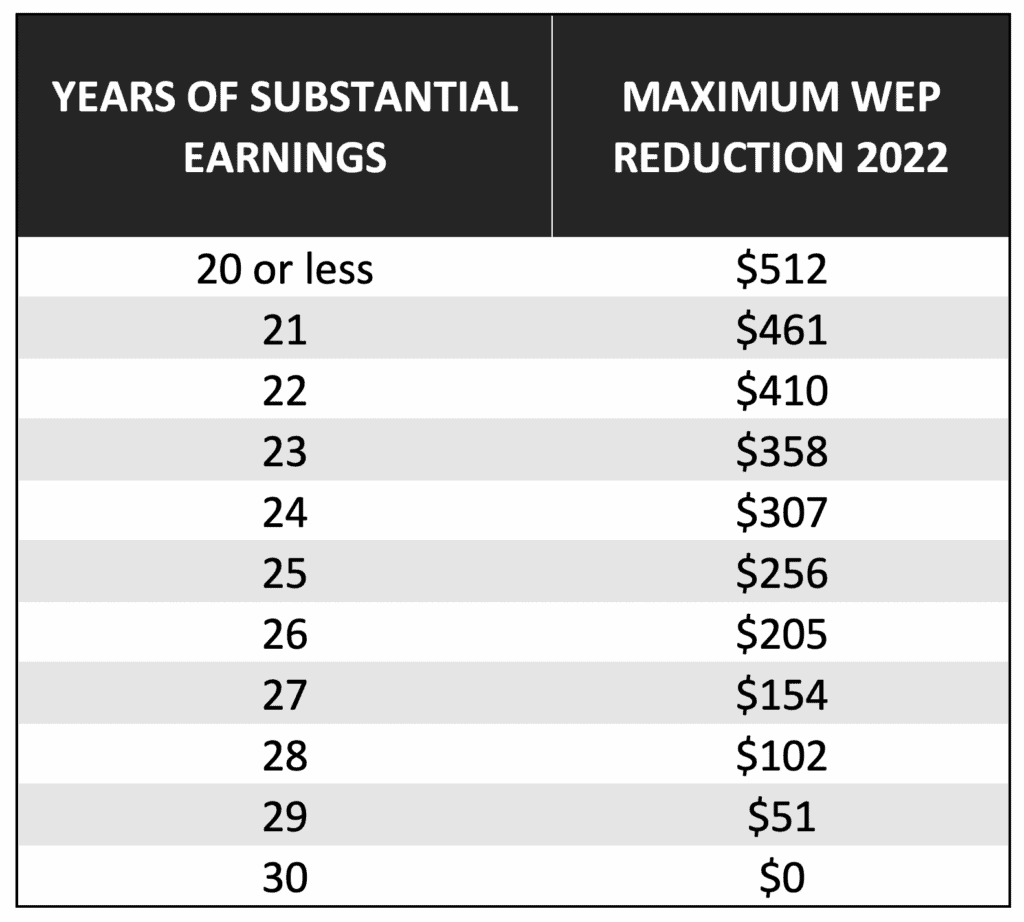

When Social Security benefits are calculated the SSA inflates your historical earnings takes your highest 35 years of earnings and divides by 420 the number of. Must contain at least 4 different symbols. The WEP provision will not eliminate all Social Security or Medicare eligibility if the worker has 40 quarters of qualifying income.

If you do not have 30 years of Social Security covered work a Social Security WEP Calculator can assist you to calculate the complex formula that will tell you your benefit amount. These rules apply only if you are collecting a non-covered pension based on your own work and some kind of Social Security benefit. Windfall Elimination Provision WEP Calculator.

The WEP applies to workers and the GPO applies to government pensioners who are applying for Social Security spousal and survivor benefits. The Windfall Elimination Provision WEP can reduce Social Security retirement benefits for workers who also have pensions from employment where they did not pay Social Security taxes as is the case for example with some state and local government jobs and for federal civil servants. For more information about how WEP works and a list of exceptions review the Windfall Elimination Provision PDF and use the WEP Calculator to see how your Social Security benefit may be affected.

6 to 30 characters long. Urban Institute economists C. In some circumstances past military service could boost your Social Security payment.

Estimate if you are eligible for a pension based on work that was not covered by Social Security. Our Windfall Elimination Provision WEP Online Calculator can tell you how your benefits may be affected. The WEP and GPO can be awful surprises so Im glad youve taken the time to research and learn.

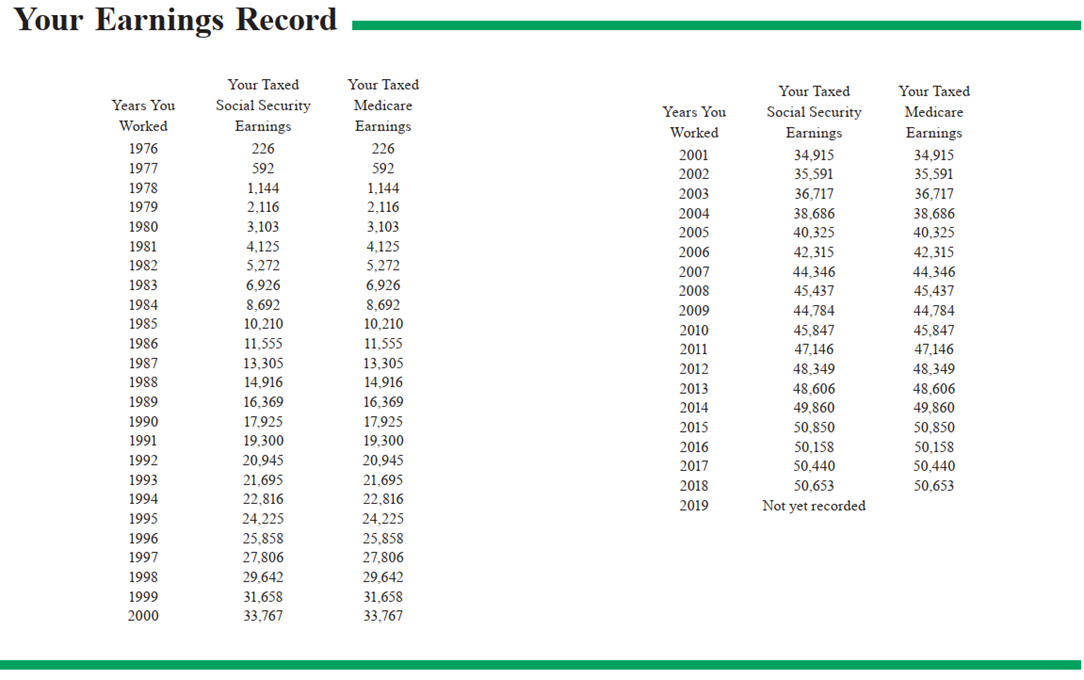

Social Securitys website provides a calculator to help you gauge the impact on your benefits from the Windfall Elimination Provision WEP the rule that reduces retirement benefits for workers who also collect a non-covered pension from a job in which they didnt pay Social Security taxesThe provision affects about 19 million Social Security beneficiaries. Estimate of spouse benefits for yourself if you receive a pension from a government job in which you did not pay Social Security taxes. You will need to enter all of your earnings taxed by Social Security which are shown on your online Social Security Statement.

If in the course of your career you worked for both 1 at least one employer that did withhold Social Security taxes and 2 at least one employer that didnt withhold Social Security taxes and that offers a pension the windfall elimination provision WEP may come into play. If you work or have worked for a company that gives you a pension based on work not covered by Social Security the basic calculators above arent an accurate representation. You will need a.

Social Security Retirement Calculator to estimate spousal benefits. The WEP may apply if you receive both a pension and Social Security. Windfall Elimination Provision WEP Government Pension Offset GPO.

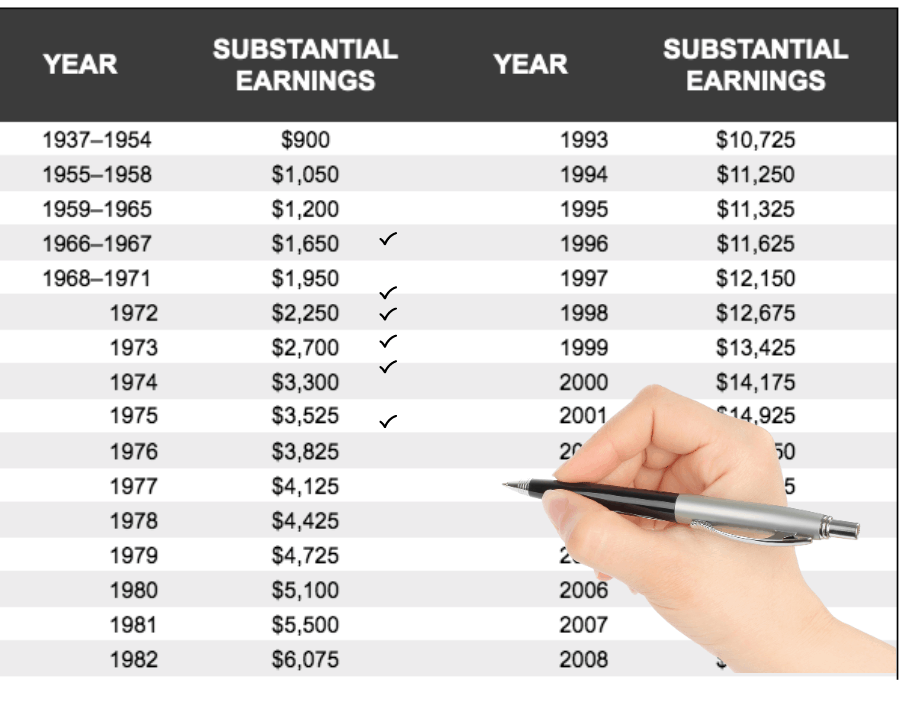

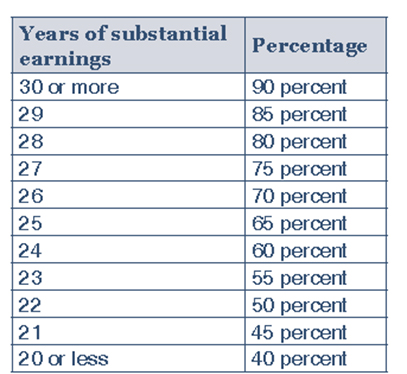

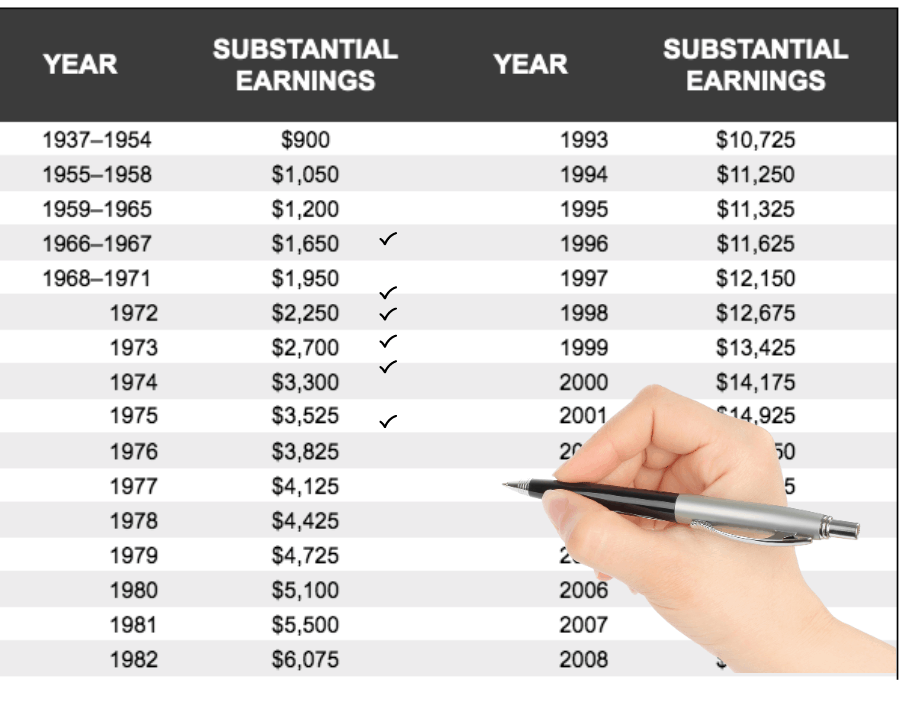

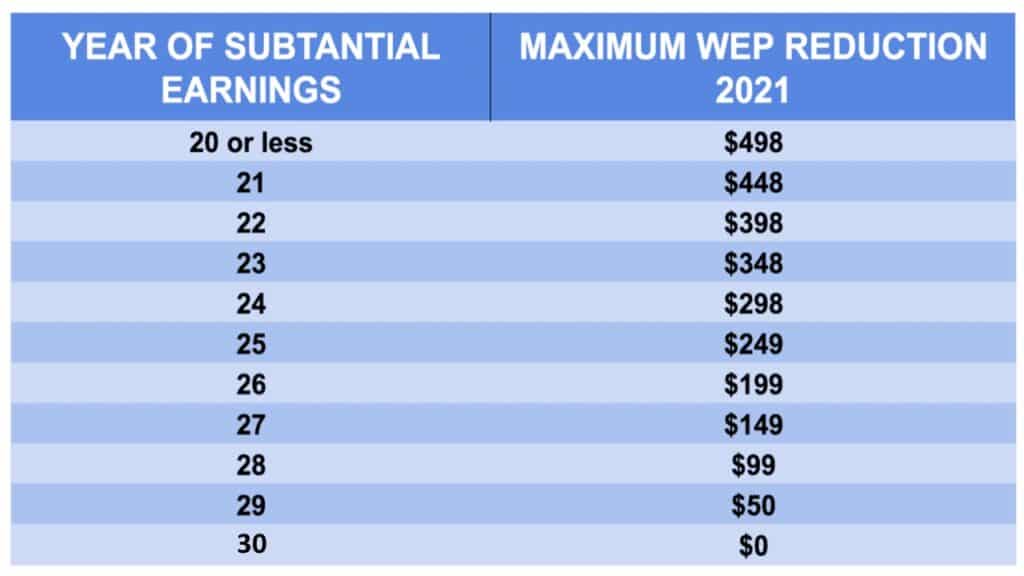

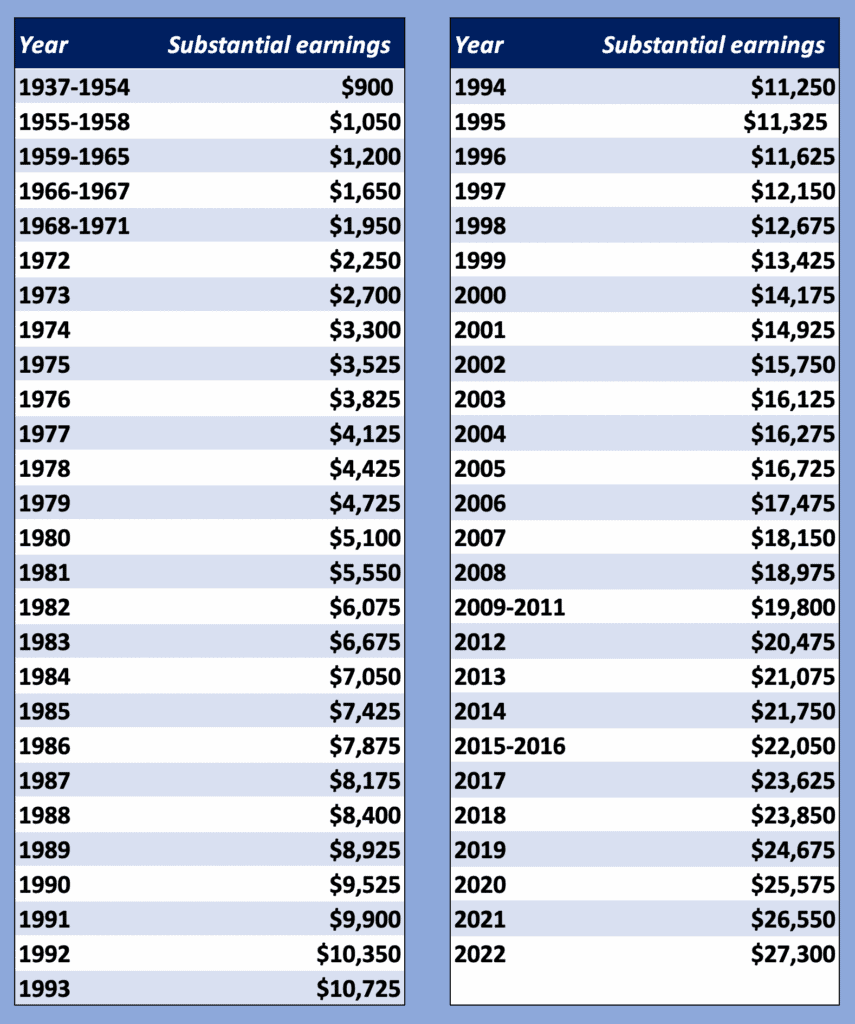

If you had between 20-30 years of substantial earnings covered by Social Security the WEP may still apply but at a reduced level. A non-covered pension earned by your spouse has no bearing. For Medicare began 1966 1971-1980 2142.

The Windfall Elimination Provision WEP affects members who apply for their own not spousal Social Security benefits. The Social Security WEP Calculator. 2 days agoAccording to the Social Security Administration about 2 million people are subject to something called the windfall elimination provision or WEP which reduces Social Security benefits in.

This calculator will tell you. Your benefit may be offset by the Government. The Windfall Elimination Provision abbreviated WEP is a statutory provision in United States law which affects benefits paid by the Social Security Administration under Title II of the Social Security ActIt reduces the Primary Insurance Amount PIA of a persons Retirement Insurance Benefits RIB or Disability Insurance Benefits DIB when that person is eligible or entitled to a.

Social Security benefit rules are different for people who had a job that was not covered by Social Security and receive a pension because of that job. Each provision when applicable will reduce. For more information about the WEP.

ASCII characters only characters found on a standard US keyboard. This document will help you understand how pensions based on such earnings affect Social Security benefits. The Windfall Elimination Provision WEP and the Government Pension Offset GPO are two components of the Social Security benefit calculation process.

While your Social Security benefits are lowered under the WEP they cannot be totally eliminated. A Social Security break even calculator can help with the decision but it can never be the sole factor used if you are serious about making a well-rounded decision. Keep in mind.

How the WEP is Calculated. Skip advert Patricia Kohlen got hit by both. Handles all Social Security benefits for ALL households.

The WEP calculator and GPO calculator at Social Securitys website can help you estimate how much these rules will cut into your benefit. No your government pension will not affect your spouses survivor benefits. The Windfall Elimination Provision affects how your Social Security retirement or disability benefits are calculated if you are also entitled to receive a pension benefit for work not covered by Social Security.

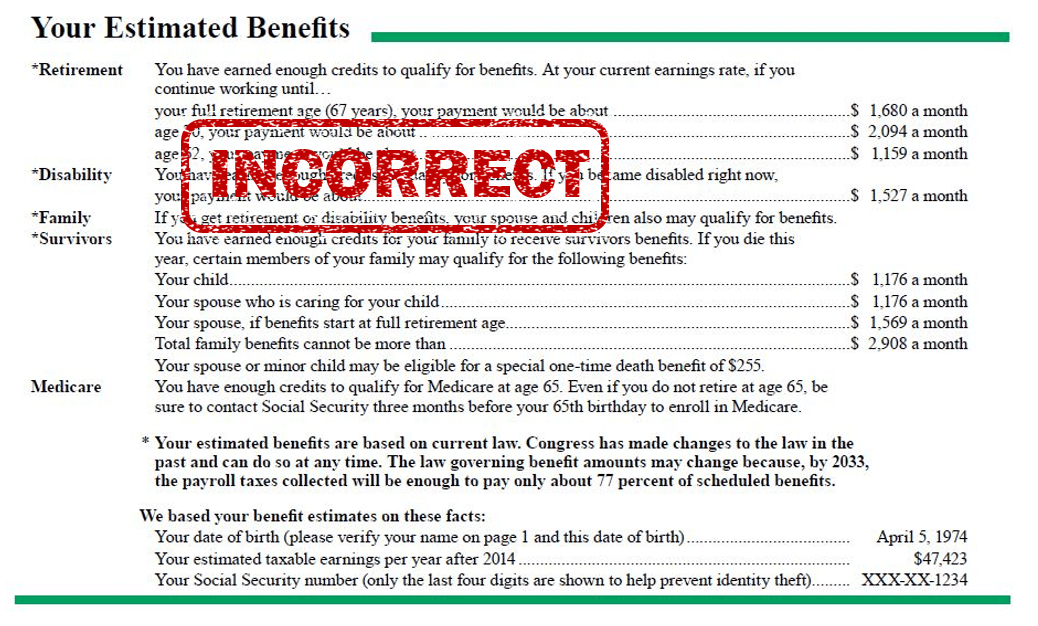

For more information see the Social Security Administrations WEP Benefit Calculator. The amount of Social Security benefit you can expect after the WEP reduction for comparison we also illustrate your benefit without considering the WEP. The impact of such earnings on Social Security benefits.

From 1940 to 2001 the SSA supplemented service members pay records with special earnings credits. Easy-to-Use Social Security Calculator. Using this calculator it is possible to estimate net Social Security benefits ie.

The age you claim benefits will affect the benefit amount for your surviving spouse.

Program Explainer Government Pension Offset

Social Security Wep Fomo Idk Or Lol Retirement Insight And Trends

Firefighter Pensions And Social Security How To Reduce Or Eliminate The Impact Of The Windfall Elimination Provision Wep Social Security Intelligence

Attorneys Discuss Calstrs Social Security Cantrell Green Workers Comp Social Security Attorneys Los Angeles Long Beach Workers Comp

Social Security Wep Fomo Idk Or Lol Retirement Insight And Trends

What S The Deal With The Wep And Gpo Pera On The Issues

Substantial Earnings For Social Security S Windfall Elimination Provision Social Security Intelligence

Repeal Wep U S House Of Representatives

Substantial Earnings For Social Security S Windfall Elimination Provision Social Security Intelligence

Substantial Earnings For Social Security S Windfall Elimination Provision Social Security Intelligence

2

Social Security Sers

The Best Explanation Of The Windfall Elimination Provision 2022 Update Social Security Intelligence

Subject To The Wep Your Social Security Statement Is Probably Wrong Social Security Intelligence

Social Security Wep Fomo Idk Or Lol Retirement Insight And Trends

How Wep Can Affect A Person S Social Security

The Best Explanation Of The Windfall Elimination Provision 2022 Update Social Security Intelligence